Happy Holidays from Stewart Valuation Intelligence!

For the final Home Value Forecast of the year, we examine trends over the past 12 months and list the top three CBSAs in the following categories:

- Highest Current Sales Price

- Current Months of Remaining Inventory

- 12 Month Sales Price Appreciation

This is the ninth year we have done this year-end analysis (previously published as Pro Teck).

CURRENT SALE PRICE

For 2022, the three California metros of San Rafael, San Francisco and San Jose earned a place atop the list of CBSAs with the Highest Current Sales Price. These three metros have been leading this category since we started this review in 2014.

Top California CBSA’s

| CBSA Name | Sold Price 2017 | Sold Price 2018 | Sold Price 2019 | Sold Price 2020 | Sold Price 2021 | Sold Price 2022 |

| San Francisco-Redwood City-South San Francisco, CA | $1,400,000 | $1,535,000 | $1,543,500 | $1,680,000 | $1,850,000 | $1,605,000 |

| San Rafael, CA | $1,189,782 | $1,354,500 | $1,350,000 | $1,544,500 | $1,610,000 | $1,625,000 |

| San Jose-Sunnyvale-Santa Clara, CA | $1,150,000 | $1,250,000 | $1,199,055 | $1,373,750 | $1,570,000 | $1,530,000 |

San Rafael has surpassed San Francisco this year for the costliest metro, and was the only one with a price increase over the year (a modest 1.18% increase versus a 11.33% decrease in San Francisco).

| CBSA Name | Sold Price | Sold Price Percentage Change |

| San Rafael, CA | $1,625,000 | 1.18 |

| San Francisco-Redwood City-South San Francisco, CA | $1,605,000 | -11.33 |

| San Jose-Sunnyvale-Santa Clara, CA | $1,530,000 | -3.16 |

As 2022 nears its end, there are nine metros where the average home costs more than $1 million.

MONTHS OF REMAINING INVENTORY (MRI)

MRI is another indicator of how “hot” a market is at a particular time. MRI equals the number of households on the market divided by the number that sell per month. If an area has a high MRI (let’s say 10 months), it means that the market is saturated — a buyer’s market. If MRI is low (below three months) then it becomes a seller’s market. A “balanced” market will have approximately six months of inventory at any given time.

The top three markets in terms of MRI for 2022 are:

| CBSA Name | MRI |

| Wichita, KS | 1.28 |

| Lewiston-Auburn, ME | 1.44 |

| Omaha-Council Bluffs, NE-IA | 1.52 |

In total, there are 88 CBSAs with MRIs under three months – last year at this time there were 182 metros with sub-three MRI, this shows that the market is slowing down with mortgage rate increases.

As of this month, 210 of the 229 CBSAs we track have MRI below the six months “balanced” market threshold, showing there’s room for more of a slowdown.

12-MONTH SALES PRICE APPRECIATION

In our report, sales price appreciation is calculated as the rolling three-month average sale price compared to the same three-month time period from the previous year.

Our December 2022 top three:

| CBSA Name | Sold Price Percentange Change |

| North Port-Sarasota-Bradenton, FL | 19.05 |

| Punta Gorda, FL | 18.75 |

| Kingsport-Bristol-Bristol, TN-VA | 17.50 |

Last year our top three all had more than a 27% price appreciation, again reflecting the slowdown:

2021 Sales Price Appreciation

| CBSA Name | Sold Price Percentage Change |

| Austin-Round Rock, TX | 31.94% |

| Provo-Orem, UT | 28.83% |

| Port St. Lucie, FL | 27.27% |

The 2023 real estate market will be dynamic as the Fed continues to increase rates to temper inflation.

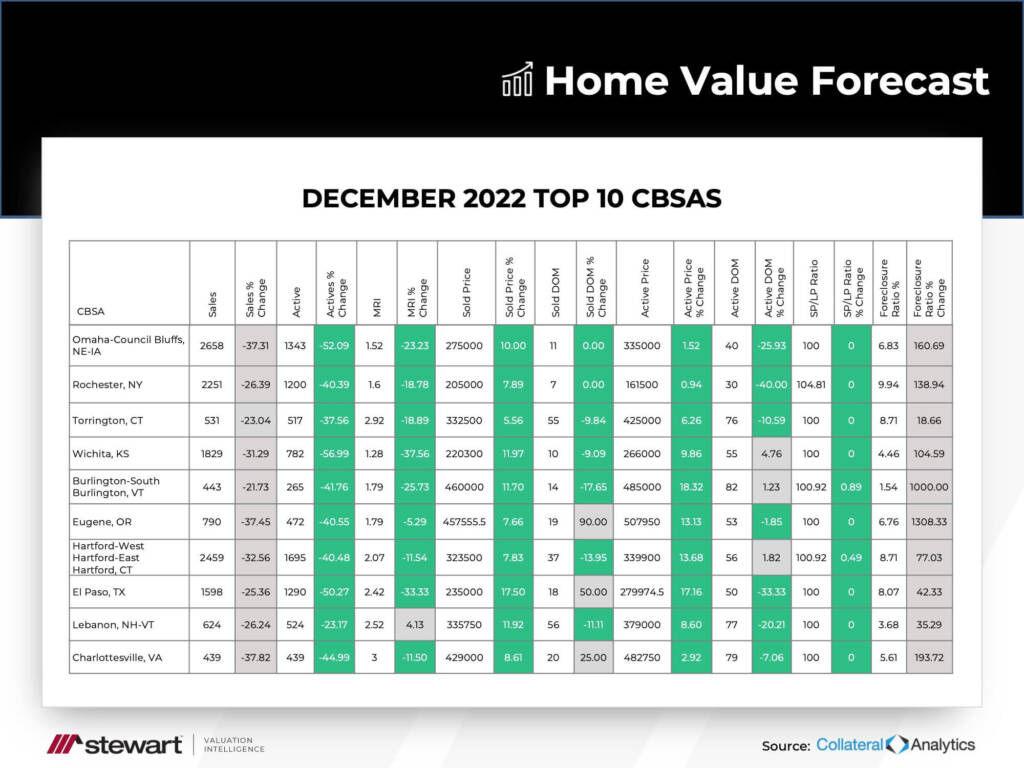

THIS MONTH’S TOP 10

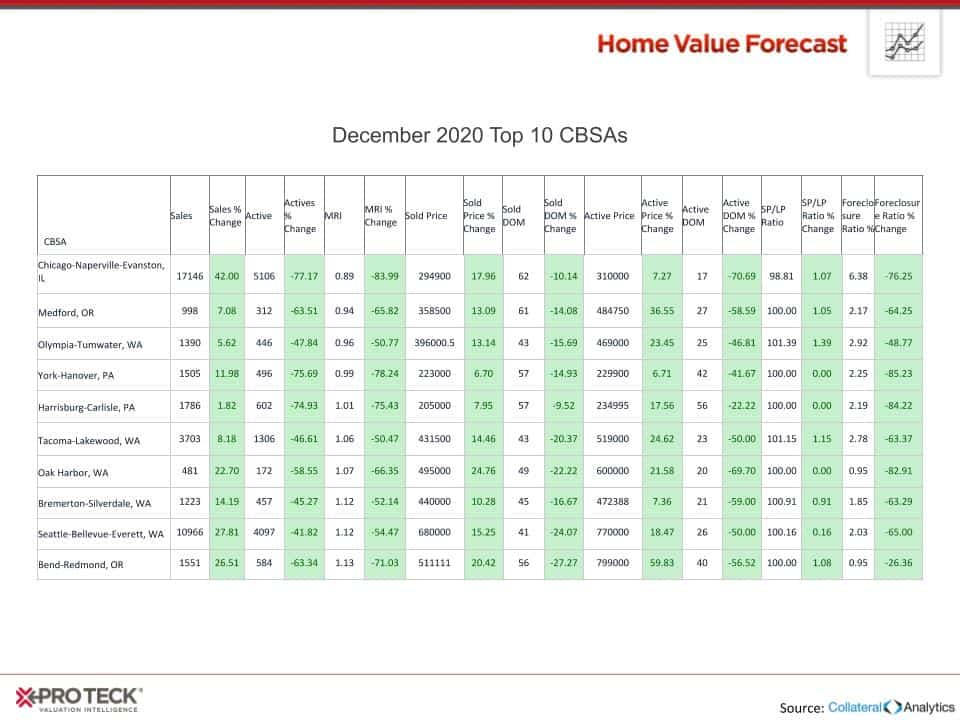

Each month, Home Value Forecast uses a number of leading real estate market-based indicators to report on activity in the single-family home markets in the top 200+ metropolitan areas (CBSAs) in the U.S., and reports on the Top 10.

The Home Value Forecast Top 10 ranking system is purely objective and is based on directional trends. It’s not a listing of what markets are most expensive or most in need of inventory — it ranks market momentum at a specific point in time.

THE LAST TOP 10 OF 2022

From all of us at Stewart Valuation Intelligence, we hope you and your family have a happy and healthy 2022!

ABOUT SVI’S MONTHLY HOUSING MARKET REPORT

The Home Value Forecast uses a ranking system that is purely objective and is based on directional trends of nine market indicators. Each indicator is given a score based on whether the trend is positive, negative or neutral for that series. For example, a declining trend in active listings would be positive, as would an increasing trend in average price. A composite score for each CBSA is calculated by summing the directional scores of each of its indicators. From the universe of the top 200+ CBSAs, each month we highlight topics and trends in the real estate market.